Comprehensive cyber insurance coverage designed for digital risks

Coalition cyber insurance policies provide the tools to help businesses manage their digital risk and the coverage to get back on their feet quickly following an incident. A policy may cover up to £10m in financial, tangible and intangible damage

Stolen funds

If social engineering leads to a fraudulent funds transfer or financial loss, our cover can help (and we’ll help you to recover the funds).

Lost business income

We can help with financial losses when a security incident brings your business offline.

Breach response costs

We can help with the legal, incident response, forensics, and PR costs following a breach, as well as the costs to notify your customers and provide credit monitoring.

Computer replacement

We’ll replace your computer systems negatively impacted by viruses and malware.

Cyber extortion

We can help with the response to a ransomware incident, including money, securities, and even crypto currencies paid.

Bodily Injury

You're covered if a connected device or industrial control system is breached, resulting in physical damage.

Terms and Conditions may apply, see Disclaimers and Licenses

Far more than traditional insurance

Digital risk changes quickly, and businesses need more than cyber insurance to protect themselves. Coalition Active Insurance gives policyholders free access to active monitoring and in-house incident response to manage risks before, during and after an incident.

Active protection

All policyholders get free active monitoring and alerting to help prevent issues before they arise

Active Response

Our in-house expert claims and incident teams responds fast so you can recover faster

We also offer

Excess Cyber Insurance

We follow the primary insurance wording

Indemnity limit up to £10 million

Wide range of industries covered, including public sector, manufacturing and professional services.

Download our Excess factsheet

Clients benefit from our cybersecurity tools

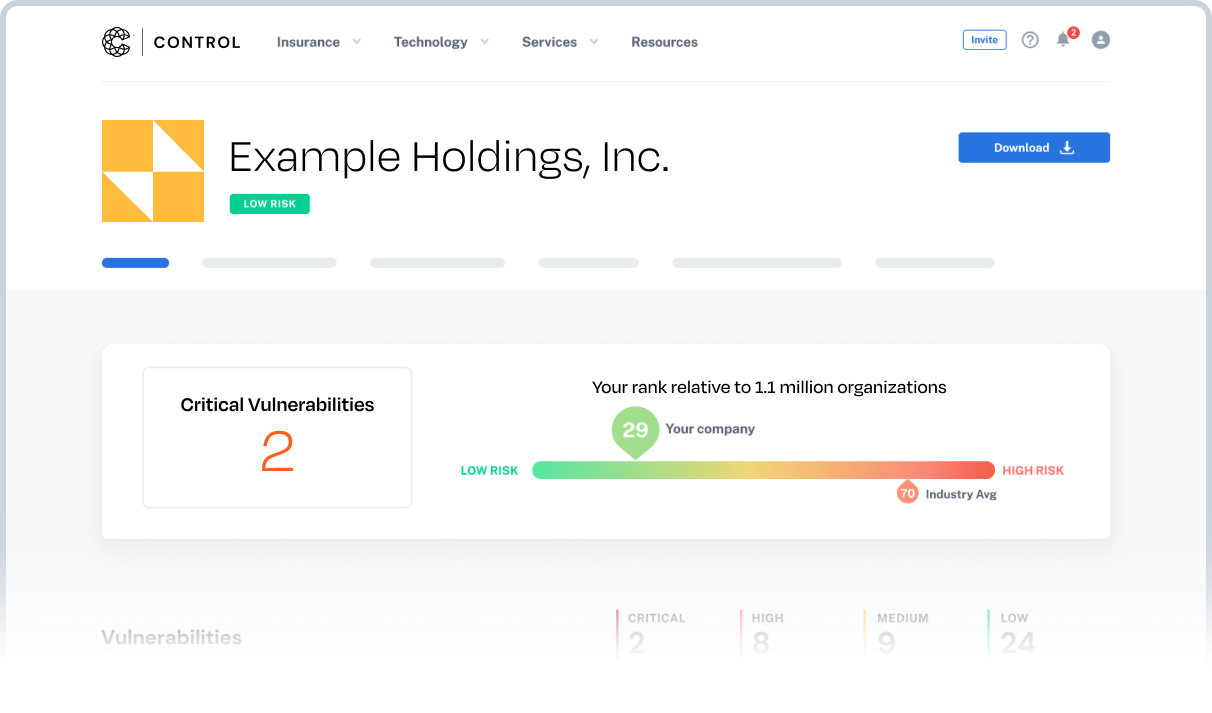

Premium access to our attack surface monitoring application, Coalition Control

24/7 access to our security support team

Threat intelligence alerts

Active risk assessment and benchmarking

5 minutes

Average response time to an incident*

45%

percentage of incidents handled at no additional expense outside the policy*

50%

coalition policyholders experience 50% fewer claims compared to the cyber industry average*

We work with some of the world's leading reinsurers

Give your clients comprehensive cyber insurance coverage underwritten by some of the world’s leading insurance providers.