Why Miscellaneous Professional Liability?

In today’s increasingly litigious world, businesses are facing more risks than ever — you can be sued over simply failing to meet a client’s expectations. Even if you’re not at fault, you can still incur costly legal fees and other expenses just to defend your business — and reputation — against the claims.

MPL coverage* from Coalition:

Helps protect against the impact of claims that you committed errors and omissions in performing a professional service

Can be added to certain Active Cyber Insurance policies* to provide coverage for legal defense costs, settlements, judgments, and other expenses

MPL Advantage

Why MPL From Coalition?

Convenient policy management

Combining Coalition’s market-leading Cyber insurance with our comprehensive MPL coverage* in one policy helps you spend less time managing your insurance and more time running your business.

Coverage you can count on

Coalition's trusted, full-limit Cyber and MPL coverages* help you fill potential coverage gaps and keep your business protected against digital threats and errors or omissions in professional services.

Streamlined claims process

Our in-house claims team of seasoned experts manages claims for both coverages in one place to make getting your business back up and running as smooth and seamless as possible.

Value beyond the policy

Our unified cyber risk management platform, Coalition Control®, helps policyholders detect, assess, and mitigate risks through ongoing threat monitoring, expert guidance, remediation support, and more.

BROKER BENEFITS

Get the best of both worlds with full-limit MPL and top-tier Cyber

Comprehensive coverage* your clients need

Market-standard MPL covers your clients’ bases without skimping on cyber

Streamlined experience from quote to bind

Adding MPL to a Cyber quote saves time and money with just a few extra questions

One comprehensive policy* for a frictionless claims experience

Spend less time coordinating claims by managing both coverages in one place

VALUE BEYOND THE POLICY

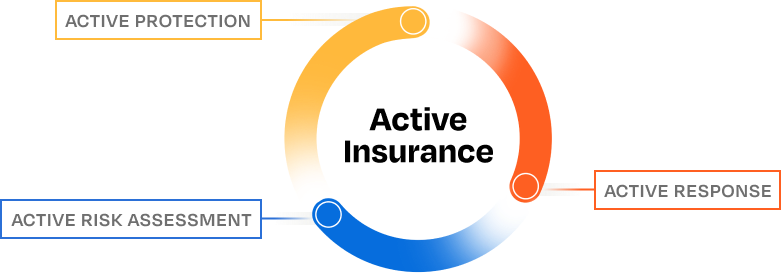

The Active Insurance Advantage

We designed Active Insurance to help prevent digital risk before it strikes.

Our unique approach to managing risk provides three layers of support.

Questions? Check out our MPL FAQ.

Still need help? Reach out to us ›

What does MPL cover*?

Companies that perform professional services can make mistakes and be subject to allegations. Miscellaneous Professional Liability provides coverage* for defense costs and legal liability incurred from errors and omissions related to professional services.

What types of claims does MPL protect against?

Common Miscellaneous Professional Liability claims include negligence, failure to provide service, misstatements or misrepresentations of the service to be performed, and errors or omissions in providing a service.

What types of businesses could benefit from MPL?

Any business that provides professional services should consider Miscellaneous Professional Liability coverage* to help protect against alleged errors and omissions specific to the professional activities they provide. Examples include but are not limited to consultants, marketing and PR firms, staffing firms, printers, interior decorators, photographers and videographers, and property managers.

Why should I add MPL coverage to my Cyber insurance policy?

Adding Miscellaneous Professional Liability insurance* to your Active Cyber Insurance policy allows you to benefit from Coalition’s industry-leading approach designed to protect against cyber risk, while closing potential gaps in coverage — like protection against claims of errors and omissions related to their professional services. Combining MPL and Cyber is typically more cost effective and more efficient to manage.

Why does "Duty to Defend" coverage* matter?

A business doesn’t need to be in the wrong to be sued. Even if a lawsuit is meritless, the business must take steps to defend itself against the claim. MPL coverage* can cover legal costs to defend a covered claim, even if the business is not at fault.